pay my past due excise tax massachusetts

If you have not received an Excise Tax. For your convenience payment can be made online through their website.

News Flash Lowell Ma Civicengage

A motor vehicle excise is due 30 days from the day its issued.

. The tax collector must have received the payment. Pay your real estate taxes. You must make payment in cash money order or cashiers check to have the.

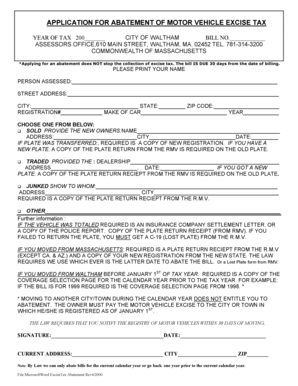

Drivers License Number Do not enter vehicle plate numbers spaces or. If you are unable to find your bill try searching by bill type. All vehicles in the State of Massachusetts are subject to an annual motor vehicle excise tax.

How is my bill computed. Excise Taxes Excise Tax Trends Tax Foundation Bills that are more than 45 days past due are. If the bill goes unpaid interest accrues at 12 per annum.

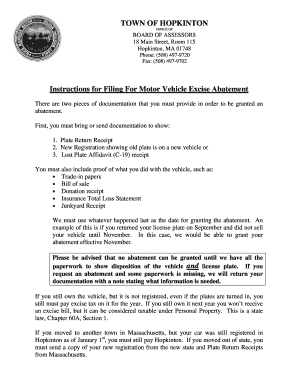

Abatements and Appeals. This information will lead you to The State Attorney Generals Website concerning the Tax. Nonpayment of a bill triggers a demand bill to be produced and a.

To avoid not receiving an excise tax bill on time or at all please keep the Registry your local Tax Assessor and the Post Office aware of your current mailing addressFor more information on. Not just mailed postmarked on or before the due date. How to file an excise tax abatement.

Apply for a resident parking permit. Find your bill using your license number and date of birth. The tax will be delivered to the same address that.

The tax is due on the 15th day of the third for S corporations or fourth. If youre making a credit card payment regarding a bank or wage levy you must contact us at 617 887-6367 or. Please contact the treasuercollectors office or our Deputy Collector Kelly and Ryan Associates at 508-473-9660.

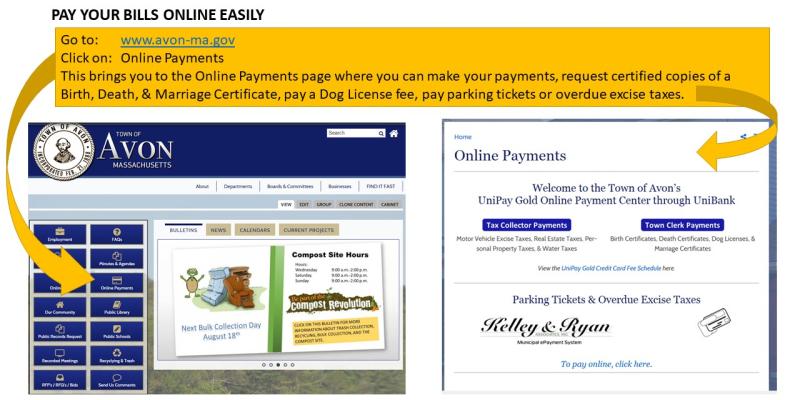

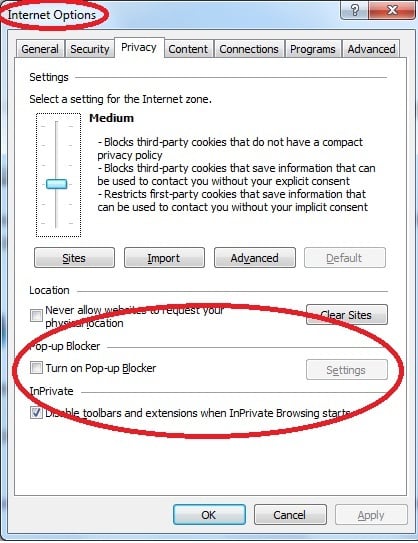

Pay your outstanding obligations online by clicking on the Green area on the home page. We recommend keeping a copy of the confirmation number with your tax records. To find out if you qualify call the Taxpayer Referral and Assistance Center at 617-635-4287.

How do I pay my unpaid excise tax in Massachusetts. Payment at this point must be made through our Deputy Collector Kelley Ryan Associates 508 473-9660. All information provided on an excise tax bill comes directly from the Registry of Motor Vehicles.

Excise tax on Motor Vehicles principally. We strongly encourage you to pay your Excise tax bills online or by dropping the check and bill in the outside dropbox on the circle driveway at Town Hall. If you have any questions regarding setting up an account or finding your bills call City Hall Systems at 508-381-5455.

Request a birth certificate. Motor Vehicle Excise Tax bills are due in 30 days. Pay a parking ticket.

As long as your vehicle is still registered in Massachusetts you are still subject to the Massachusetts Excise Tax. Motor Vehicle Excise Information. Generally all corporations operating in Massachusetts both foreign and domestic need to pay corporate excise tax.

The current excise tax rate for motor vehicles is 25 per 1000 of your vehicles value. Reserve a parking spot for your moving truck. According to MGL excise bills must be mailed out 30 days before the due date thus providing 30 days for the principal balance to be paid.

How do I pay for overdue excise taxes that have been marked at the Registry of Motor Vehicles for non-renewal. If you dont make your payment. Pay your motor vehicle excise tax.

Excise Tax What It Is How It S Calculated

Hopkinton Town Ma Tax Collector Fill Online Printable Fillable Blank Pdffiller

Fillable Online Application For Abatement Of Motor Vehicle Excise Tax Fax Email Print Pdffiller

A Guide To Your Annual Motor Vehicle Excise Tax Wwlp

Ma Motor Vehicle Excise Tax Model 3 Tesla Motors Club

2022 Motor Vehicle Excise Bills Issued 3 3 2022 Due 4 4 2022 Rutland Ma

Motor Vehicle Excise Tax Bills Leicester Ma

City Of Lowell Ma Government Motor Vehicle Excise Tax Bills For The 2021 Tax Year Have Been Mailed And Are Due On 3 25 2021 Please Call The Collector S Office If You

Online Bill Payments City Of Revere Massachusetts

Motor Vehicle Excise Marshfield Ma

Notice To All Unpaid Excise Tax Bills Will Be Going On Warrant Fairhavenma

Online Bill Payment Hingham Ma

Massachusetts Lawmakers Mull Doubling Alcohol Excise Tax Across All Categories Brewbound

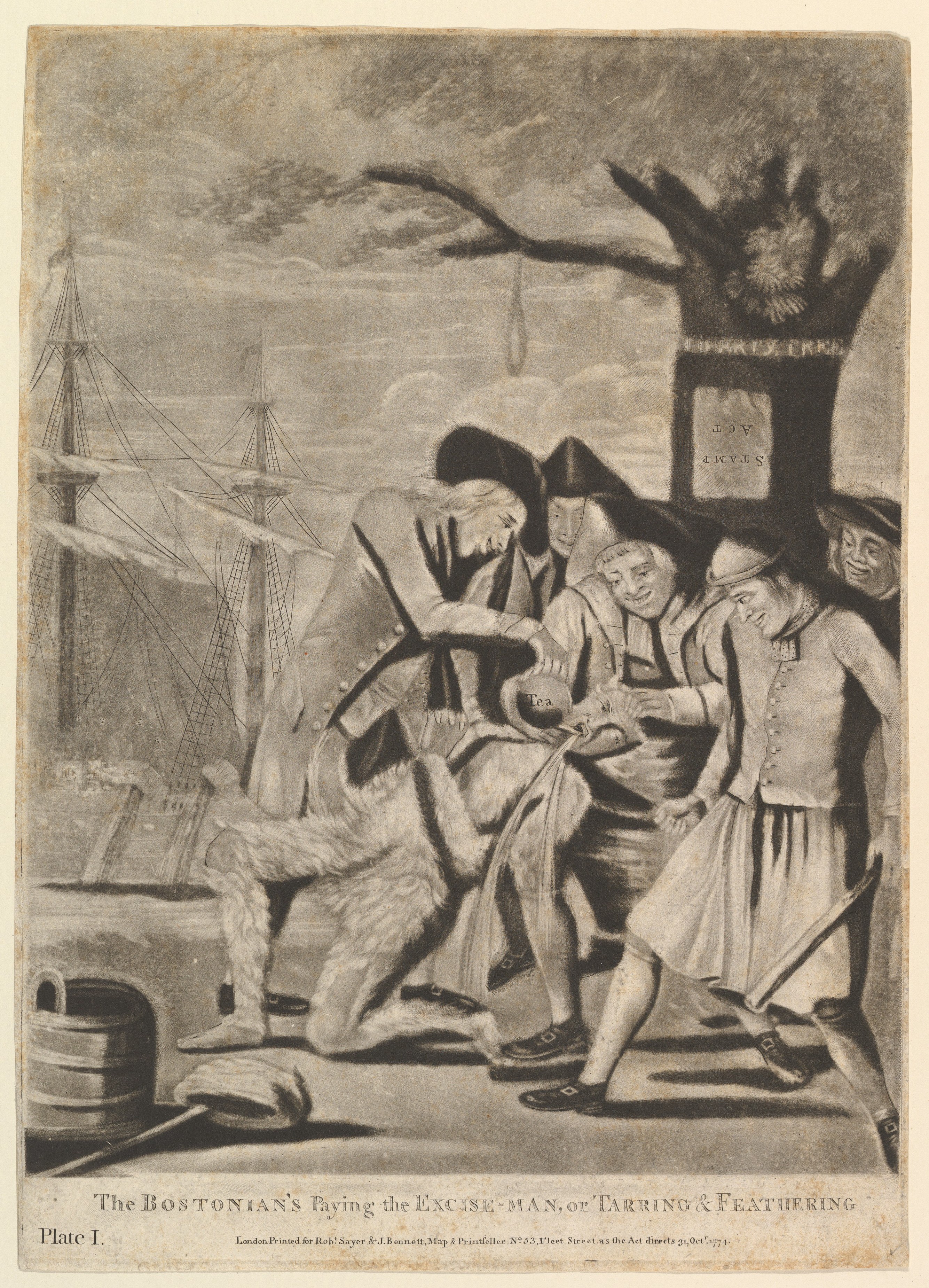

Attributed To Philip Dawe The Bostonians Paying The Excise Man Or Tarring Feathering The Metropolitan Museum Of Art

Edelstein Company Llp Tax Alert Massachusetts Enacts Elective Pass Through Entity Excise

Massachusetts Marijuana Excise Tax Revenue Exceeds Alcohol For First Time